Company

First Republic Bank – a traditional bank for the wealthy.

Prompt

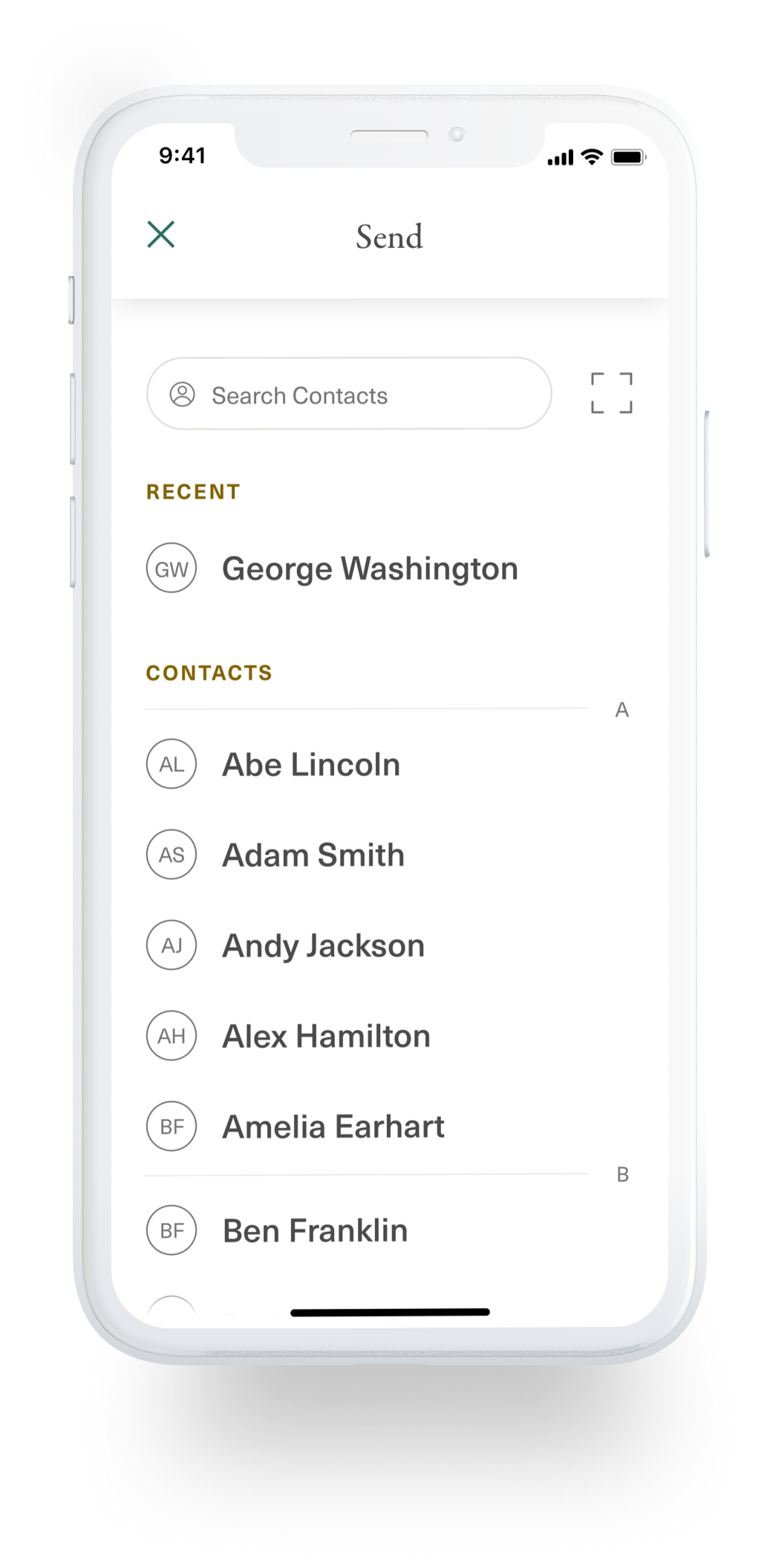

Design a peer-to-peer payment feature for the bank's existing mobile app. Design deadline: 4 weeks.

Goal

Expand the mobile app's value to increase the number of monthly active users.

My Role

I led this design process with support from my team at Y Media Labs.